The bilateral trade relationship between Afghanistan and Pakistan during the first half of 2025 (H1 2025, January–June) presented a paradox: stability in numbers masking profound fragility on the ground. Official data from Afghanistan’s Ministry of Industry and Commerce (MoIC) confirmed total trade reached $1.108billion in H1 2025, representing a minimal -0.8% nominal decline compared to the figure of more than $1.117billion recorded in the same period of 2024.

The figures maintained a significant trade imbalance, with Afghan exports totaling $277 million and Pakistani exports standing at $712 million. This stagnation was not a reflection of diminished market demand but rather a catastrophic failure of systemic reliability, where geopolitical and security instability directly imposed non-economic costs on commerce, actively suppressing growth potential.

The Geopolitical Choke Point: The Torkham Crisis

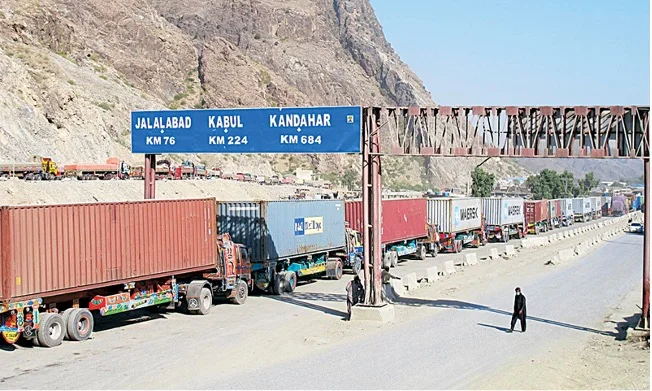

The defining characteristic of H1 2025 was the frequent and protracted operational disruptions at key land crossings. The most damaging incident occurred at Torkham, the busiest border point, which was closed continuously for nearly a month. The route was shut down starting February 21, 2025, following a dispute over construction activities, specifically the renovation of an Afghan security post. Tensions escalated into a severe security crisis on March 3, 2025, when an exchange of fire between Afghan Taliban fighters and Pakistani security forces on both sides resulted in the death of an Afghan security personnel.

The crossing was fully reopened only on March 22, 2025. This single incident inflicted an estimated loss of $72 million in trade revenue. The month-long impasse stranded thousands of trucks carrying essential goods and highly perishable Afghan exports, such as coal, cotton, and fresh fruits. Shakirullah Safi, chief executive of the Nangarhar Chamber of Commerce, reported that Afghan traders were losing $500,000 a day due to the closure, with 5,000 containers stuck on both sides. Afghan businessman Rasul Hojat reported a personal loss of one million Afghanis due to spoiled cargo.

Beyond Torkham, other crossings like Chaman, Ghulam Khan, and Kharlachi also faced frequent closures and restrictions. This reactive policy, driven by ongoing TTP-related security concerns, utilized a “two-track formula” of targeted military responses paired with guarded trade openness. Coal trader Noor Khan from Jalalabad stressed that this continuous issuance of new restrictions following security incidents severely impacted trade and called for commerce to be de-linked from politics.

The Collapse of Transit Trade and Strategic Diversification

While bilateral trade figures showed marginal resilience, the performance of Afghanistan’s vital transit trade through Pakistan suffered a catastrophic structural collapse. Due to instability and Pakistan’s import and anti-smuggling restrictions, the volume of Afghanistan’s transit trade plummeted from $2.87 billion in the fiscal year 2023–2024 to approximately $1.1 billion in the fiscal year 2024–2025. This massive redirection of cargo flow signals a structural abandonment of the Pakistani corridor.

The instability has driven Afghan traders toward alternative, more reliable regional routes, primarily Iran’s Chabahar Port. Chabahar is a strategically superior option, being approximately 700 kilometers closer to Afghanistan than Pakistan’s Karachi Port for certain routes. This proximity translates directly into tangible cost savings, estimated to reduce container transport expenses by $500 to $1,000 per container. For Afghanistan, this diversification is a strategic necessity to reduce dependency on a partner that frequently uses border control as political leverage.

Afghanistan’s push for stability extends beyond Iran into Central Asia. Infrastructure development, such as the logistics hub inHerat and proposals like the “Road of Five Nations” (linking China, Kyrgyzstan, Tajikistan, Afghanistan, and Turkmenistan), demonstrates an intent to reposition Afghanistan as a stable transit junction. These efforts are designed to reduce the decades-long reliance on Pakistan, which historically handled over 80% of Afghan trade. The instability of H1 2025 has simply validated and accelerated this strategic push toward diversification.

Policy Response and Future Pathways

The severe logistical and policy obstacles of H1 2025 forced subsequent diplomatic efforts. Following a high-level visit by Deputy Prime Minister Ishaq Dar to Kabul, both sides signed a Preferential Trade Agreement that led to the Early Harvest Programme (EHP), effective August 1, 2025 (post-H1). The EHP provided tariff concessions on key agricultural goods. Pakistan reduced import duties on Afghan grapes, apples, and pomegranates by 26% (to 27%), and on tomatoes from 27% to 22%.

Reciprocally, Afghanistan cut the duty on Pakistani potatoes by 35% (from 57% to 22%). These remedial measures, while positive, must now counteract the structural damage inflicted during H1 2025. Unless both governments can permanently insulate trade from political disputes and guarantee reliability at crossings like Torkham and Chaman, the long-term erosion of Pakistan’s status as Afghanistan’s primary trade gateway will continue, cementing the market share gains made by rival corridors like Chabahar.

Also Read: Forging Prosperity: Pakistan and Afghanistan’s New Chapter in Trade